April 17 / 2025 / Reading Time: 3 minutes

Large Brokerage - Preventing Catastrophic Breaches

Company: Financial Brokerage Revenue: Undisclosed Employees: 5,000

When a leading financial brokerage processing billions in daily transactions recognized the critical need to strengthen their cybersecurity posture, they faced a challenge that would test every aspect of their security infrastructure. The stakes couldn't have been higher—a single breach could result in catastrophic financial losses and irreparable damage to their reputation built over decades.

This is the story of how OSec partnered with this financial institution to conduct a comprehensive security transformation that would ultimately set new standards for trading platform protection in the industry.

The Challenge: Protecting High-Stakes Financial Operations

In today's hyper-connected financial markets, trading platforms represent some of the most attractive targets for sophisticated cyber criminals. Our client understood this reality all too well. Processing over $2.5 billion in daily transactions across multiple asset classes, their platform served thousands of professional traders who demanded both lightning-fast execution and bulletproof security.

The brokerage's leadership team approached OSec with a clear mandate: conduct a no-holds-barred security assessment that would uncover any vulnerability, no matter how deeply hidden, before malicious actors could exploit them.

In the world of high-frequency trading, security can't be an afterthought—it must be woven into every microsecond of every transaction. - CISO

Our Approach: Beyond Traditional Testing

We deployed a multi-faceted testing methodology designed to stress-test every component of the platform's security architecture. Our approach went far beyond traditional vulnerability scanning, employing techniques that mirrored the sophistication of nation-state actors and organized cybercrime syndicates.

Red Team Exercises

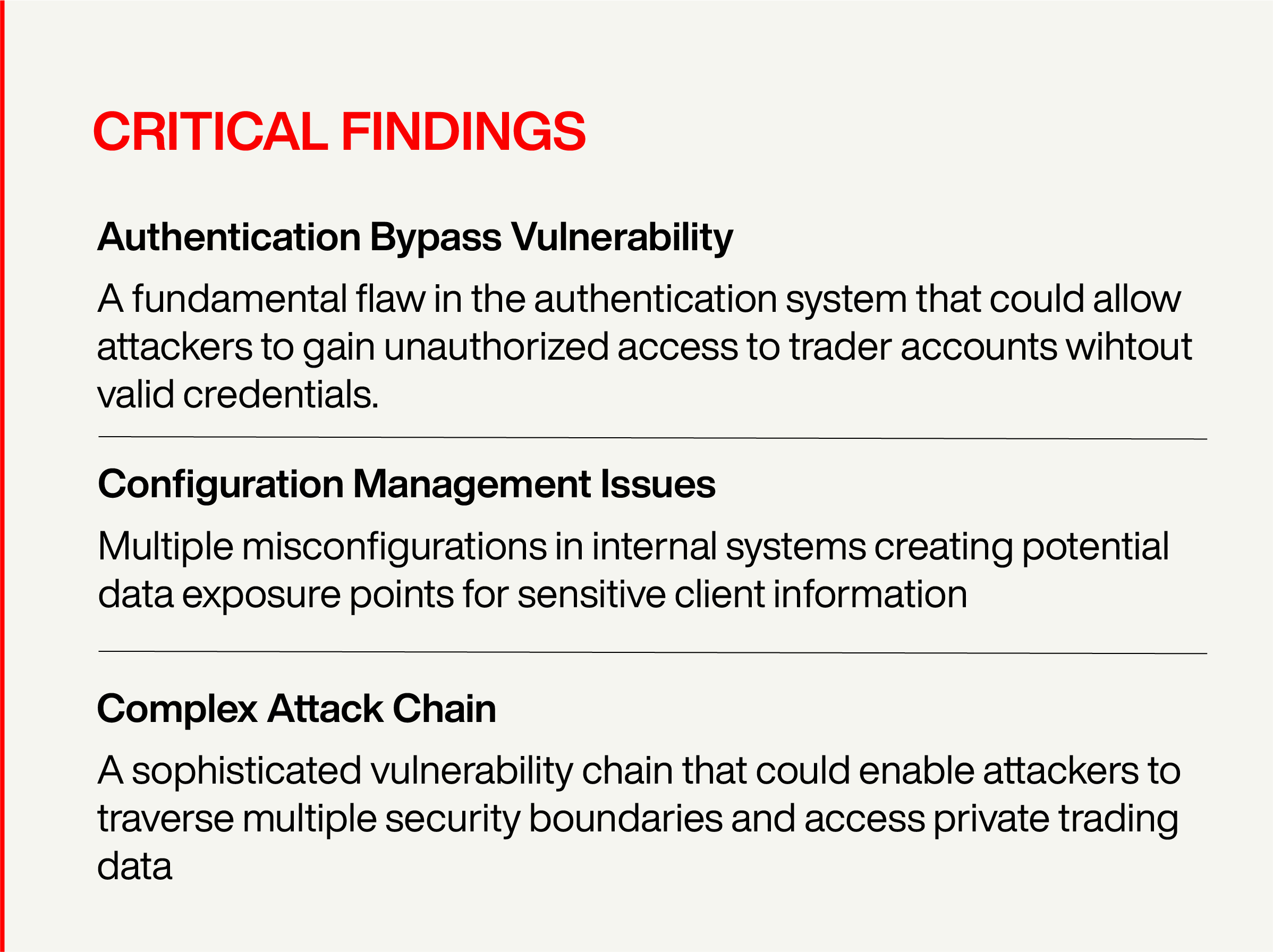

Our elite red team operators simulated advanced persistent threats, employing tactics, techniques, and procedures (TTPs) observed in real-world attacks against financial institutions. These exercises revealed how determined attackers might chain together seemingly minor vulnerabilities to achieve significant compromise.

Application Security Deep Dive

We conducted exhaustive testing on critical trading applications, examining everything from API endpoints to data validation processes. Our team analyzed millions of lines of code, searching for logic flaws that automated tools might miss.

Human Factor Assessment

Recognizing that people often represent the weakest link in security, we launched sophisticated phishing simulations designed to test staff awareness and response protocols. These campaigns revealed critical gaps in security awareness that technical controls alone couldn't address.

The Transformation: From Vulnerable to Fortified

What followed was an intensive remediation effort that would transform the brokerage's security posture. Working hand-in-hand with their internal teams, we didn't just patch vulnerabilities—we re-imagined their entire approach to platform security.

Implemented Security Enhancements

- Continuous Security Validation: Established automated testing pipelines that continuously probe for vulnerabilities in production environments

- Multi-Factor Authentication Overhaul: Deployed token-based authentication systems, eliminating single points of failure in user verification

- Monitoring Improvements: Moved monitoring solutions beyond default "out of the box" configurations to detect complex attacks.

Lessons Learned: Security as a Competitive Advantage

This engagement reinforced several critical truths about modern financial security. First, even the most sophisticated organizations can harbor hidden vulnerabilities that only emerge through comprehensive testing. Second, the combination of technical assessments and human-factor testing provides the most complete security picture.

Perhaps most importantly, we learned that security transformation doesn't have to come at the expense of performance. By designing security into the platform's architecture rather than bolting it on, we actually improved system performance while dramatically enhancing protection.

The Road Ahead

Six months after completing the initial transformation, the brokerage continues to maintain an exemplary security posture. Regular assessments show sustained improvement, and the platform has successfully defended against several sophisticated attack attempts that would have likely succeeded against their previous infrastructure.

The brokerage's commitment to security has become a competitive differentiator, attracting security-conscious institutional clients who recognize the value of a truly secure trading environment. What began as a security assessment evolved into a comprehensive transformation that redefined what's possible in financial platform protection.