Why API Security Demands a Sector-Specific Approach

These endpoints are now the primary vector of attack because they carry critical transactional and personal data.

In modern financial institutions, APIs enable everything from core banking operations and mobile transactions to partner integrations and customer identity verification. Their ubiquity and power make them high-value targets. Adversaries exploit these interfaces to bypass perimeter defenses, manipulate platform behavior, and compromise sensitive information.

Security in this domain requires more than traditional firewalls or token checks. It demands active governance, real-time behavioral insight, and infrastructure-aware controls designed for a sector that operates in high-risk, regulated environments.

Where Most API Controls Fall Short

While baseline protections such as authentication and rate limiting are foundational, they rarely match the complexity of financial services environments.

Common vulnerabilities include:

Shadow APIs | APIs that operate outside formal governance, creating unmonitored entry points into critical systems |

Poor Token Hygiene | Weak token management and expiration enforcement leading to prolonged unauthorized access |

Third-Party API Risks | Overlooked partner APIs with elevated access privileges and insufficient security controls |

Business Logic Gaps | Complex vulnerabilities that aren't caught by static scanning tools but enable transaction manipulation |

OSec addresses these challenges by delivering deep API discovery, behavior-aware threat detection, and tailored policy enforcement. Our approach integrates into operational workflows to improve visibility without disrupting development velocity.

Strengthening API Security Through Advanced Testing

OSec combines deep security research with real-world attack simulation to uncover vulnerabilities before adversaries do. Our comprehensive approach includes:

API Penetration Testing

Deep-dive assessments targeting authentication bypasses, injection flaws, and business logic vulnerabilities specific to financial APIs

Red Team Exercises

Simulated attacks against your API ecosystem to test detection capabilities and incident response procedures

Purple Team Operations

Collaborative exercises where our attackers work with your defenders to improve API security controls and monitoring

Security Research

Cutting-edge research into emerging API attack vectors, zero-day vulnerabilities, and financial sector-specific threats

Continuous Threat Exposure Management

Ongoing scanning and manual testing to identify new exposures as your API landscape evolves

Risk-Based Reporting

Detailed findings mapped to business impact, with actionable remediation guidance prioritized by real-world exploitability

Explore our security testing services:

Incenter's Role in Continuous API Security Testing

Incenter, OSec's continuous threat exposure management (CTEM) platform, transforms API security from periodic assessments to ongoing validation.

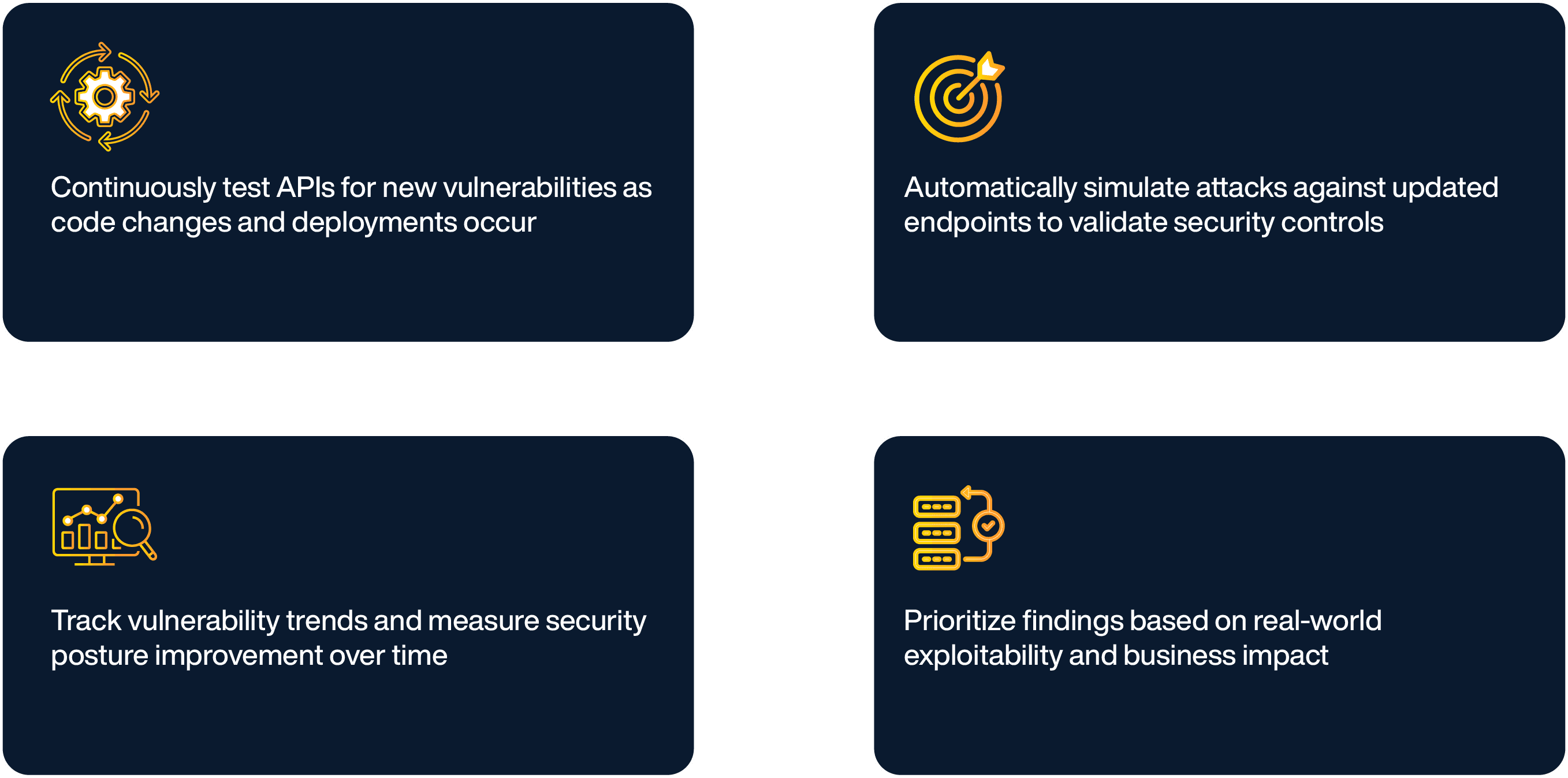

Our platform enables teams to:

Unlike traditional point-in-time assessments, Incenter provides persistent visibility into your API attack surface, ensuring new vulnerabilities are discovered and validated as your infrastructure evolves.

Take Control of Your API Exposure

Meet with OSec to review your API landscape, uncover hidden risks, and outline a defensible strategy for API governance and resilience.